During early November 2015, River Logic launched an online survey for Operations Research (OR) professionals. The poll was conducted across social media, including LinkedIn, Twitter and Facebook. Special emphasis was made to reach members of The Institute for Operations Research and the Management Sciences (INFORMS) which, according to INFORMS’ website, is “the largest society in the world for professionals in the field of operations research (O.R.), management science, and analytics.”

During early November 2015, River Logic launched an online survey for Operations Research (OR) professionals. The poll was conducted across social media, including LinkedIn, Twitter and Facebook. Special emphasis was made to reach members of The Institute for Operations Research and the Management Sciences (INFORMS) which, according to INFORMS’ website, is “the largest society in the world for professionals in the field of operations research (O.R.), management science, and analytics.”

River Logic’s own optimization modeling platform, Enterprise Optimizer® (EO), and its built-in LP and MILP solver, Mixed Integer Optimizer© (MIO), were intentionally excluded from the survey questions.

VP Product Management and in-house Operations Research expert, Eric Kelso, presents the results while also offering deeper insight into what the data means for OR professionals and the industry, at large. (Please note: for many questions, respondents were allowed to select more than one choice per question, so total percent per question may exceed 100.)

Sample Population

To provide a summary of respondent group:

- By profession – consultant (31%), student (31%), software developer (28%), other (18%) and professor/teacher (10%).

- Top five industry focuses – other (36%), military (18%), airlines / aviation (15%), healthcare (13%) and other manufacturing (8%).

- Top five sources for research and innovations in operations research – Search Engines (62%), OR/MS Today (36%), Mathematics of Operations Research (21%), Interfaces (18%) and the OR Society (18%).

Results

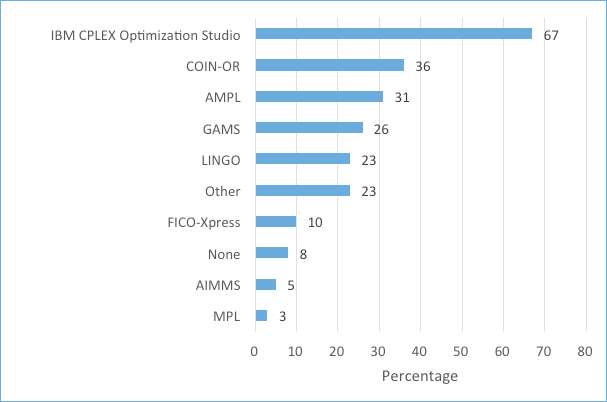

Linear Programming software used

The linear programming (LP) modeling software market has existed for over 25 years. Today, it is highly fragmented with many different but similar programs commercially available.

This question’s choices included what we considered to be the top eight mathematical modeling packages, in part due to their higher visibility within INFORMS. At least 15 other such programs can be found and should be assumed in the “Other” category below.

The results of this question had a few surprises:

- Only 8% had never used any LP software. Meaning, although operation researchers often specialize in one of many different topics — e.g., decision analysis, queuing problems — nearly all respondents had some experience creating LP models, even if just in a classroom setting.

- Of the 92% who had experience, 67% had used IBM® CPLEX® Optimization Studio and 36% had used COIN-OR, both higher than I thought they would be.

- Only 5% had used AIMMS, which was lower than I had guessed. This result made me wonder if most models constructed require AIMMS’ professional staff to lead or assist.

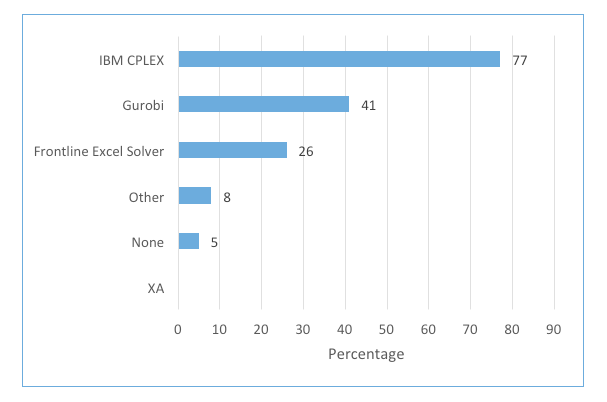

LP and MILP solvers used

The LP and MILP solver market is even more fragmented than the mathematical modeling software market. This question included what we considered to be the top commercial solvers, although probably at least 30 such programs exist.

Note: Respondents were asked to select all that apply

At least based on their visibility within INFORMS, it is not too surprising that the dominant commercial solvers are IBM® ILOG® CPLEX® (77%), Gurobi® (41%) and Frontline Solvers® (26%). With only 8%, the Other category likely means the remaining two-dozen solver programs are competing for a rather small piece of the total solver market.

Given IBM’s size, Gurobi’s aggressive growth, and Frontline’s ability to leverage the massive Microsoft Excel® market, I would be surprised if any new or existing solver vendors can break into the top three in the foreseeable future. If anything, Gurobi might take market share from IBM CPLEX. Both IBM CPLEX and Gurobi are likely to take market share from Frontline and the many small vendors. This will be particularly true as LP and MILP modeling focus shifts to holistic, Integrated Business Planning (IBP)-style models, which will exceed Excel’s inherent limitations and require serious computational capabilities.

For the 5% of respondents had never used LP and MIP solvers, this also makes sense as it tracks fairly close to the 8% who had never used any LP package before.

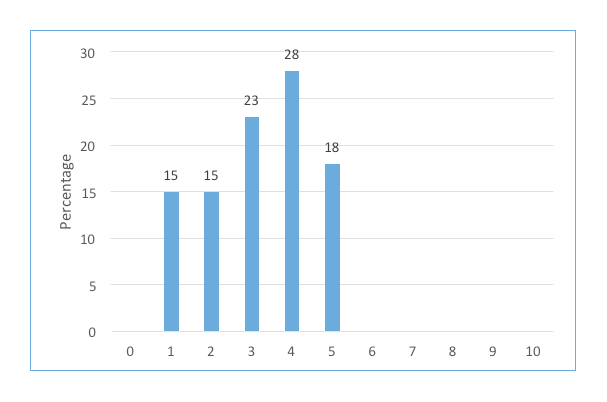

Knowledge of finance and accounting

Although not considered an OR topic, we at River Logic consider knowledge of finance and accounting particularly important for applying OR to practical, real-world problems.

For example, of the thousands of models built in Enterprise Optimizer® over the last 15 years, less than 1% had an objective function defined to optimize a non-financial unit of measure (e.g., minimize waste, maximize truckloads, etc.) Nearly all EO users fully utilize its ability to optimize on a financial metric like profit, NPV, or cash; and to display solution results using customized profit-and-loss, balance sheet and cash flow statements.

When asked to rate their knowledge of finance and accounting on a 1 to 10 scale (1 being very low, 10 being expert), the average rating was a 4.4 with the most frequent response being 3 out of 10. Not one respondent was confident enough to even select a 6.

This result should not be particularly surprising given how the OR profession has evolved over the last 75 years. Most OR undergrad and graduate programs teach mostly the spectrum of OR topics. Students specialize in just one or two areas prior to graduation. Many graduates then stay in academia, while some accept highly specialized positions focused on creating specific algorithms to solve narrow problems.

Only those OR professionals who have taken finance or accounting coursework — possibly in an MBA program or who were employed with a consulting or software company focused on solving business problems — are likely to have any significant knowledge of these subjects. Generally, these results support the fact that most OR professionals don’t understand finance and accounting.

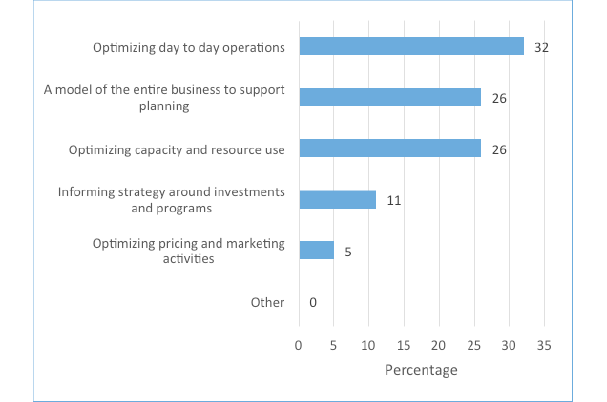

Delivering transformational value with optimization

As an OR professional who has worked in the industry for 25 years, I know that to successfully deploy a prescriptive analytics application using algebraic modeling software tools, it can take months or even years. A lot of work is involved, as well as aligning with management and holding to realistic budgets. Consequently, most OR professionals are tasked to solve problems with limited scope and limited budget. The end result is a sub-optimal solution with less visibility — and sometimes less job satisfaction.

This question was designed to give the respondents an opportunity to state what they might rather be focused on.

The results here are interesting for several reasons. First, one would assume that many companies have already optimized their day-to-day operations, given that long-established software for scheduling, supply chain optimization, transportation optimization, etc. have existed for years. Clearly, one third of respondents believe their company/client could do more — and they could do more for their company/client — by optimizing day-to-day operations. Importantly, these OR professionals view their role somewhat myopically as operational “problem solvers” instead of helping to set their company’s strategy or tactics.

Conversely, both Integrated Business Planning (IBP)-style modeling (26%) and optimizing capacity and resource use (26%) indicate a desire to think bigger. While not the same, they are closely related. Well-designed IBP models should naturally attempt to optimize all important decisions in the company, including any available (and future) capacity and resources. I believe this combined 52% will grow to be an even bigger number in the future.

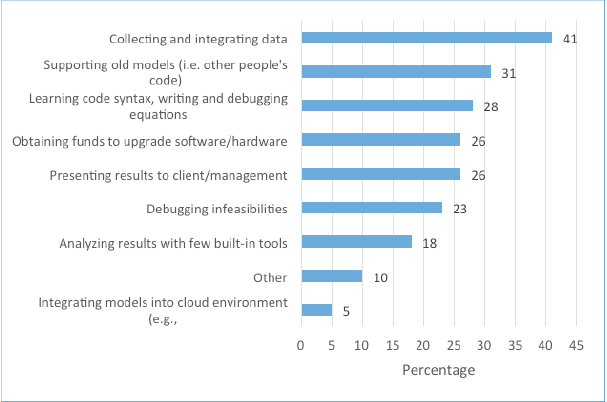

Greatest challenges faced in an OR Professional’s day-to-day job

Given the wide range of job titles and responsibilities, this list could have been nearly endless. For the survey, we selected 9 choices (including “Other”) that we believed were representative.

It was not surprising that 41% of survey respondents stated that “collecting and integrating data” was the greatest challenge faced in their day-to-day job. It is a common complaint across many OR professionals. Especially in very large companies, the process of extracting data from existing ERP systems like SAP can be daunting, and the time taken is sometimes measured in years. For an OR professional, it can be difficult to find success and satisfaction when your job depends on the company’s IT department finishing a big ERP project!

The second (31%) and third (28%) responses are very closely related — time spent learning and debugging code. Junior-level OR professionals might enjoy coding models using algebraic modeling software, but at some point either they will no longer enjoy it or their management will tire of the long model-building time frames, missed deadlines, or the possibility for embarrassing bugs to be found at the most in-opportune times. [At River Logic, these are the reasons why our consulting partner network is rapidly adopting Enterprise Optimizer®.

The fourth response, funding issues (26%), is also related to the second and third. If you think about it, most senior managers won’t spend money on new modeling software and/or hardware until at least the current projects are successful. No one wants to admit they made a mistake; that they should have bought different software or better hardware, even though it would be best for the company in the long run.

The fifth (26%), sixth (23%) and seventh (18%) choices are again related to the ones above. Most modeling packages have very little (if any) debugging tools out of the box. Even fewer have built-in visualizations and analytics reporting. These nice-to-have features will only grow in importance in the next decade. Any modeling package that does not provide the user out-of-the-box ability to visualize results, in a format ready-made for client or management team presentations, will become obsolete.

It’s easy to overlook the remaining choice for “integrating models in a cloud environment” (5%), but I urge you not to. Progressive companies are switching to cloud-based planning. Consider the success of salesforce.com and Office365. Then, consider what deploying optimization-based planning models in a secure public or private cloud might mean. While many companies are still concerned about data security and costs those issues will be largely overcome in the next decade. I expect this 5% will continue to grow rapidly. LP and MILP modeling and solver software vendors who are prepared for this evolution will grow rapidly at the expense of those who do not.

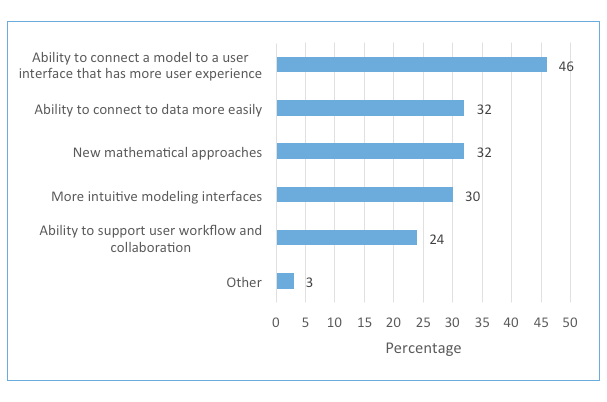

Increasing the impact of an OR professional’s work

Similar to the last question, this question gave respondents a chance to offer a wish list. Nearly 50% selected “ability to connect a model to a user interface” as one of their top two choices. Given the state of the algebraic modeling software market over the last 25 years, this response is not surprising whatsoever. Those packages, with slight exceptions, do not offer any built-in user interface. Everything that an OR professional must do to connect a model to a user interface must be done using traditional programming languages (e.g., C++, .NET) or using Microsoft Excel® with VBA. Unless the budget includes funds for a real software development exercise, most user interfaces tend to end up looking like they were built by a modeler — and not so great. (I know this to be true, because this was my job prior to joining River Logic 15 years ago!)

The second most popular response, “ability to connect to data more easily” (32%), should not surprise anyone since the prior question had “collecting and integrating data” as the greatest challenge. Traditional modeling software packages often specify data inputs as text files or other old-style approaches. OR professionals are clearly looking for better approaches using wizards and easier connectors.

The third “new mathematical approaches” (32%) and fourth “more intuitive modeling interfaces” (30%) also confirm that the existing mathematical modeling software market has likely reached full maturity. Many respondents are looking for something new; something easier that provides a better user experience. Software vendors that provide these capabilities in the future will flourish; while those that don’t will continue to live off of support and maintenance until even that disappears.

I actually find the fifth response “ability to support user workflow and collaboration” (24%) as the most interesting. Traditionally, it can be difficult for most modeling software to offer collaboration. This is clearly an opportunity for software companies to invest in features that OR modelers want.

Overall, OR professionals build models for others

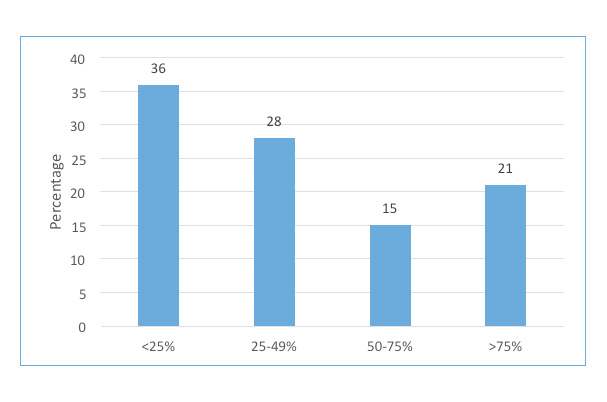

This last question was asked to gauge the level of in-house versus external software developers or consultants.

About 65% of modelers surveyed spend less than half their time building models for their own consumption versus for other users. This tracks closely to the 61% of respondents who said they were either a consultant or software developer.

20% reported they spend at least 75% of their time building models for their own consumption. This indicates that internal OR groups still exist, but percentage-wise only about one-third of OR professionals work for the company they’re building models for.

Closing Thoughts

On behalf of River Logic, I would especially like to thank everyone who took the time to respond. I hope the survey results have been helpful. Please feel free to contact us if you have any questions or comments.