Requirements for True What-if Scenario Analysis

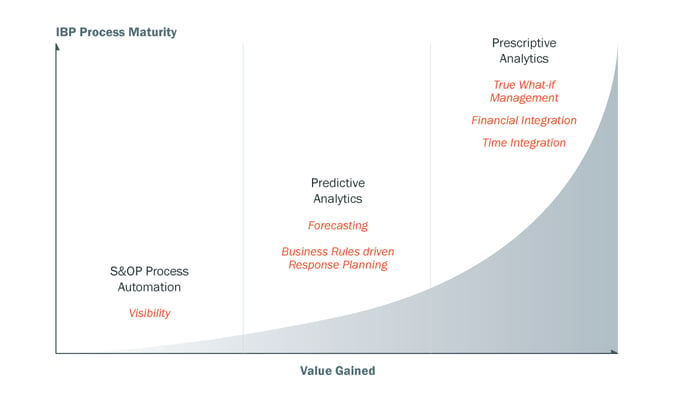

In this post we explore the requirements of true what-if scenario analysis capabilities and the necessary integration across 3 key dimensions - Operational, Financial and Time, framed through the 3 stages of S&OP maturity that companies fall into, as shown in Figure 1.

Stage 1: S&OP Process Automation

Excel remains the tool of choice for companies embarking on their S&OP journey. When they finally realize the huge challenges that Excel brings—namely that S&OP process proliferation always results in a lack of a single version of the truth—they switch to an S&OP system of record toolkit/solution. Unfortunately, these tools only allow companies to automate their existing process, which remains sub-optimal.

Figure 1. Maturity Levels of Organizations in terms of S&OP Technology Adoption

Stage 2: Predictive Analytics

The second stage in this evolution is to add predictive analytics capabilities on top of the existing automated S&OP process like forecasting or planning engine driven supply planning. These solutions are driven by heuristics or best practices that, again, unfortunately, do not create an optimal solution (they may not even create a feasible solution). The advantage of this approach is that users feel in control and have the ability to make manual changes on top of the predictive analytics heuristics. Like the first stage, the decisions made based on predictive analytics remain sub-optimal.

Stage 3: Prescriptive Analytics

The third stage in this evolution is to further enhance the demand plans created by predictive tools, including rough cut supply-demand balanced plans, and fine tune it through “True What-If Scenario Analysis”. This approach involves modeling the business at a desired (and often detailed) level including the various constraints involved in its operation. A scenario dashboard allows users to modify levers associated with the business (costs, capacity, demand, products) as well as their objectives in terms of business strategy (e.g. maximize revenue, maximize net income, minimize inventory). The impact of this change in business strategy must be identified immediately in an intuitive way for the user.

Requirements for Prescriptive Analytics based What-If Scenario Analysis

Ability to model operational and financial data simultaneously

Business rules/heuristics by definition does not consider global constraints that span multiple dimensions such as operational, financial and time. Another gap is that S&OP solutions have evolved from a supply chain and logistics heritage and hence do not have deep financial modeling capabilities. Doing S&OP on top of an operational hierarchical model (based on aggregation/disaggregation) and handing it over for financial translation is inadequate because the optimization becomes locally focused on heuristics such as cost per unit vs. globally optimizing for total financial impact on the company. Furthermore, in a sequential process budget/finance constraints are not represented and these are equally, if not more important, than operational constraints.

Ability to perform optimization across strategic, tactical and operational time horizons

A big challenge with traditional S&OP solutions is that they were designed to solve an operational problem with monthly frequencies. For a strategic horizon, the ability to model the network, do capital investment analysis, take decisions regarding closing facilities, and modeling currency fluctuations takes precedence. For a tactical horizon, the ability to model facilities down to the workstation level, the ability to model batch processing, lot sizes and yields takes precedence. Traditional S&OP solutions thus focus only on operational time frames.

Extending beyond demand shaping to consider which demand is preferable

Traditional S&OP solutions take the demand plan as an input, and at best they allow users to prioritize which demand they want to fulfill first. This is a manual, trial and error process where the “strategic” customers always win. Whether the company engages in bid support, customer negotiations, trade promotions or marketing, there is a significant opportunity for companies to evaluate the product, customer and price/discount/promotional mix. But this evaluation must happen in the context of a global optimization, whereby the marginal impact on profit is evaluated simultaneously with the supply and financial plans. By doing this, not only will profits increase, the entire organization will evolve into an advanced level of managing customer, product and campaign profitability.

For an example of a company that does this type of prescriptive analytics, take a look at the Cox Industries Case Study.